0

0 评论

0 股票

社交所

消息

设置

常用

最新动态

我的好友

我的照片

我的文章

我的收藏

了解

发现好友

元宇宙

搜索

- Pranju Pranju 分享了一个链接Nanotechnology Market Overview by Advance Technology, Future Outlook 2030

This report studies the Nanotechnology Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Nanotechnology Market analysis segmented by companies, region, type and applications in the report.

The report offers valuable insight into the Nanotechnology Market progress and approaches related to the Nanotechnology Market with an analysis of each region. The report goes on to talk about the dominant aspects of the market and examine each segment.

Top Key Players:

• Showa Denko

• KK

• BASF SE

• Pen Inc

• Nanosys Inc.

• QD Vision

• Arkema

• 3rd Tech Inc.

• ApNano Materials

• ELITechGroup

• Bruker Nano GmbH

Read the Detailed Index of the Full Research Study @ https://www.datalibraryresearch.com/market-analysis/nanotechnology-market-4808

The Global Nanotechnology Market segmented by company, region (country), by Type, and by Application. Players, stakeholders, and other participants in the global Nanotechnology Market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type, and by Application for the period 2023-2030.

Market Segment by Regions, regional analysis covers

• North America (United States, Canada and Mexico)

• Europe (Germany, France, UK, Russia and Italy)

• Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

• South America (Brazil, Argentina, Colombia, etc.)

• Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Research objectives:

• To study and analyze the Nanotechnology Market size by key regions/countries, product type and application, history data from 2018 to 2020, and forecast to 2030.

• To understand the structure of Nanotechnology Market by identifying its various sub segments.

• Focuses on the key global Epigenetics players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

• To analyze the Epigenetics with respect to individual growth trends, future prospects, and their contribution to the total market.

• To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

• To project the size of Epigenetics submarkets, with respect to key regions (along with their respective key countries).

• To analyze competitive developments such as expansions, agreements, new product launches and acquisitions in the market.

• To strategically profile the key players and comprehensively analyze their growth strategies.

• To strategically profile the key players and comprehensively analyze their growth strategies.

The report lists the major players in the regions and their respective market share on the basis of global revenue. It also explains their strategic moves in the past few years, investments in product innovation, and changes in leadership to stay ahead in the competition. This will give the reader an edge over others as a well-informed decision can be made looking at the holistic picture of the market.

Key questions answered in this report

• What will the market size be in 2030 and what will the growth rate be?

• What are the key market trends?

• What is driving this market?

• What are the challenges to market growth?

• Who are the key vendors in this market space?

• What are the market opportunities and threats faced by the key vendors?

• What are the strengths and weaknesses of the key vendors?

Table of Contents: Nanotechnology Market

• Part 1: Overview of Nanotechnology Market

• Part 2: Epigenetics Carts: Global Market Status and Forecast by Regions

• Part 3: Global Market Status and Forecast by Types

• Part 4: Global Market Status and Forecast by Downstream Industry

• Part 5: Market Driving Factor Analysis

• Part 6: Market Competition Status by Major Manufacturers

• Part 7: Major Manufacturers Introduction and Market Data

• Part 8: Upstream and Downstream Market Analysis

• Part 9: Cost and Gross Margin Analysis

• Part 10: Marketing Status Analysis

• Part 11: Market Report Conclusion

• Part 12: Epigenetics: Research Methodology and Reference

Browse More Reports:

• Intelligent Process Automation Market

• Oleochemical Market

• Excavator Market

• Fencing Market

About Us: Data Library Research is a market research company that helps to find its passion for helping brands grow, discover, and transform. We want our clients to make wholehearted and long-term business decisions. Data Library Research is committed to delivering its output from market research studies that are based on fact-based and relevant research across the globe. We offer premier market research services that cover all industries verticals, including agro-space defense, agriculture, and food, automotive, basic material, consumer, energy, life science, manufacturing, service, telecom, education, security, technology. We make sure that we make an honest attempt to provide clients an objective strategic insight, which will ultimately result in excellent outcomes.

Contact Us: Rohit Shrivas,

Senior Manager International Sales and Marketing

Data Library Research

info@datalibraryresearch.com

Ph: +13608511343 (US)

Follow Us:

LINKEDIN | FACEBOOK | TWITTER

Nanotechnology Market Overview by Advance Technology, Future Outlook 2030 This report studies the Nanotechnology Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Nanotechnology Market analysis segmented by companies, region, type and applications in the report. The report offers valuable insight into the Nanotechnology Market progress and approaches related to the Nanotechnology Market with an analysis of each region. The report goes on to talk about the dominant aspects of the market and examine each segment. Top Key Players: • Showa Denko • KK • BASF SE • Pen Inc • Nanosys Inc. • QD Vision • Arkema • 3rd Tech Inc. • ApNano Materials • ELITechGroup • Bruker Nano GmbH Read the Detailed Index of the Full Research Study @ https://www.datalibraryresearch.com/market-analysis/nanotechnology-market-4808 The Global Nanotechnology Market segmented by company, region (country), by Type, and by Application. Players, stakeholders, and other participants in the global Nanotechnology Market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on revenue and forecast by region (country), by Type, and by Application for the period 2023-2030. Market Segment by Regions, regional analysis covers • North America (United States, Canada and Mexico) • Europe (Germany, France, UK, Russia and Italy) • Asia-Pacific (China, Japan, Korea, India and Southeast Asia) • South America (Brazil, Argentina, Colombia, etc.) • Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa) Research objectives: • To study and analyze the Nanotechnology Market size by key regions/countries, product type and application, history data from 2018 to 2020, and forecast to 2030. • To understand the structure of Nanotechnology Market by identifying its various sub segments. • Focuses on the key global Epigenetics players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years. • To analyze the Epigenetics with respect to individual growth trends, future prospects, and their contribution to the total market. • To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks). • To project the size of Epigenetics submarkets, with respect to key regions (along with their respective key countries). • To analyze competitive developments such as expansions, agreements, new product launches and acquisitions in the market. • To strategically profile the key players and comprehensively analyze their growth strategies. • To strategically profile the key players and comprehensively analyze their growth strategies. The report lists the major players in the regions and their respective market share on the basis of global revenue. It also explains their strategic moves in the past few years, investments in product innovation, and changes in leadership to stay ahead in the competition. This will give the reader an edge over others as a well-informed decision can be made looking at the holistic picture of the market. Key questions answered in this report • What will the market size be in 2030 and what will the growth rate be? • What are the key market trends? • What is driving this market? • What are the challenges to market growth? • Who are the key vendors in this market space? • What are the market opportunities and threats faced by the key vendors? • What are the strengths and weaknesses of the key vendors? Table of Contents: Nanotechnology Market • Part 1: Overview of Nanotechnology Market • Part 2: Epigenetics Carts: Global Market Status and Forecast by Regions • Part 3: Global Market Status and Forecast by Types • Part 4: Global Market Status and Forecast by Downstream Industry • Part 5: Market Driving Factor Analysis • Part 6: Market Competition Status by Major Manufacturers • Part 7: Major Manufacturers Introduction and Market Data • Part 8: Upstream and Downstream Market Analysis • Part 9: Cost and Gross Margin Analysis • Part 10: Marketing Status Analysis • Part 11: Market Report Conclusion • Part 12: Epigenetics: Research Methodology and Reference Browse More Reports: • Intelligent Process Automation Market • Oleochemical Market • Excavator Market • Fencing Market About Us: Data Library Research is a market research company that helps to find its passion for helping brands grow, discover, and transform. We want our clients to make wholehearted and long-term business decisions. Data Library Research is committed to delivering its output from market research studies that are based on fact-based and relevant research across the globe. We offer premier market research services that cover all industries verticals, including agro-space defense, agriculture, and food, automotive, basic material, consumer, energy, life science, manufacturing, service, telecom, education, security, technology. We make sure that we make an honest attempt to provide clients an objective strategic insight, which will ultimately result in excellent outcomes. Contact Us: Rohit Shrivas, Senior Manager International Sales and Marketing Data Library Research info@datalibraryresearch.com Ph: +13608511343 (US) Follow Us: LINKEDIN | FACEBOOK | TWITTERNanotechnology Market Size, Segmentation & Forecast By 2030The Nanotechnology Market holds a valuation of $92.5 billion, with an impressive Compound Annual Growth Rate (CAGR) of 19.5% anticipated throughout the forecast by 2030.WWW.DATALIBRARYRESEARCH.COM0 0 评论 0 股票 - How DLF South Facilitates Work-Life Balance

DLF South fosters work-life balance by offering a harmonious blend of modern amenities and serene surroundings. With well-designed spaces, recreational facilities, and convenient access to daily essentials, residents can seamlessly balance professional commitments and personal well-being in this vibrant community.

Read More:- https://dlfcityfloors.in/blog/how-dlf-south-facilitates-work-life-balance/How DLF South Facilitates Work-Life Balance DLF South fosters work-life balance by offering a harmonious blend of modern amenities and serene surroundings. With well-designed spaces, recreational facilities, and convenient access to daily essentials, residents can seamlessly balance professional commitments and personal well-being in this vibrant community. Read More:- https://dlfcityfloors.in/blog/how-dlf-south-facilitates-work-life-balance/1 0 评论 0 股票 - Maximize Priya 添加了一张照片Telemedicine Market Overview

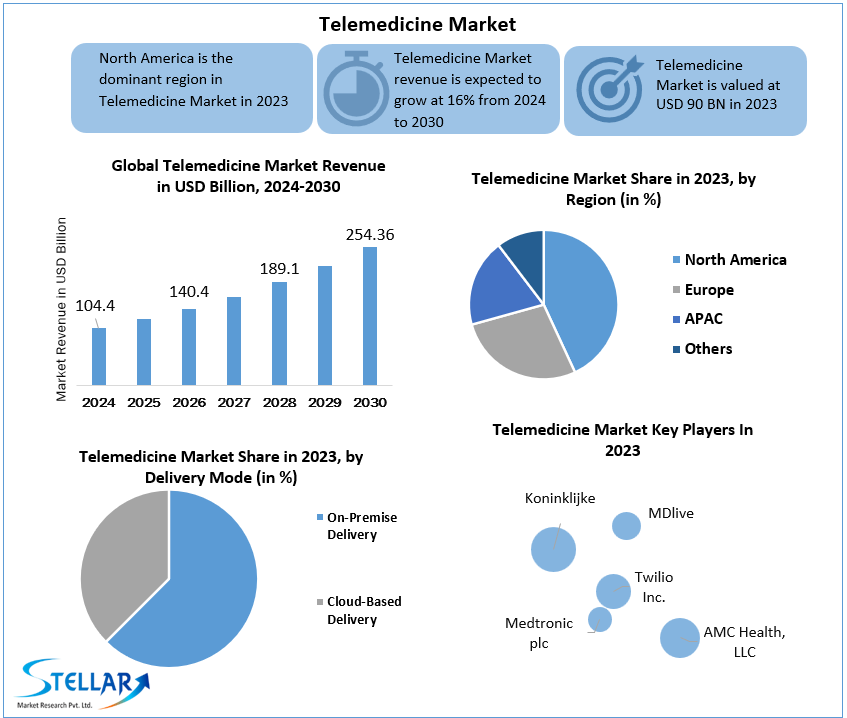

The market growth drivers and challenges, as well as company plans, procedures, and a detailed financial strategy, are all explored in the research. Customization, as well as extensive information about Telemedicine industry potential, meets customer expectations. The global “Telemedicine market” study investigates the industry's competitive landscape and leading players.

Request for Free sample _https://www.stellarmr.com/report/req_sample/Telemedicine-Market/1601

Telemedicine Market Report Scope and Research Methodology

The report clearly represents a global Telemedicine Market structure, which includes current trends in the market and forecasts to identify potential investment areas. It consists of various factors affecting the global Telemedicine market such as historical data, recent technological development, competitive landscape and government policy. The Telemedicine Market report provides information on major drivers, restraints, challenges and opportunities for clients. For easy understanding, the market has been divided into three major segments and these major segments of the Telemedicine Market were further divided into various sub-segments. The report also includes a segment-wise analysis of the factors influencing the market growth with the competitive analysis, major market players have been included in the report by their expansion plans, product, investments, pricing and presence in the Telemedicine industry.

Both primary and secondary research methods were used and the data collected for the Telemedicine Market report by using these methods were combined to draw accurate and error-free inferences. The primary research included interviews with subject-matter experts, Telemedicine industry participants, high-level executives of key market players, industry consultants and other experts. The Telemedicine Market report includes a PESTLE analysis, which aids in the development of company strategies. SWOT analysis was conducted to provide the strengths and weaknesses of the Telemedicine Market.

Request for Free sample _https://www.stellarmr.com/report/req_sample/Telemedicine-Market/1601

Telemedicine Market Regional Insights

Europe, North America, Asia-Pacific, the Middle East and Africa, and Latin America are the five regions that make up the global Telemedicine market. The report forecasts the revenue growth at global, regional and country levels in terms of USD value from 2023 to 2030. Regional analysis with the Telemedicine market size of each region is included in the report. The countries portion of the research examines a variety of market elements that are expected to influence current and future Telemedicine market trends, as well as changes in market rules at the country level. Some of the primary components used to forecast each country's Telemedicine market situation include consumption, production location and amount, import/export analysis, pricing analysis, raw material prices, and upstream and downstream value chain analysis.

Telemedicine Market Segmentation

By Delivery Mode

On-Premise Delivery

Cloud-Based Delivery

By Application

Teleradiology

Telepsychiatry

Telepathology

Teledermatology

Telecardiology

Others

By End User

Providers

Payers

Patients

Other

Telemedicine Market Key Players

Koninklijke Philips N.V.

American Well Corporation

Medtronic plc

Siemens AG

AMC Health, LLC

The Cigna Group

Teladoc Health Inc.

General Electric Company

Oracle Corporation

MDlive, Inc. (Evernorth)

Twilio Inc.

Doctor On Demand, Inc. (Included Health)

Zoom Video Communications, Inc.

SOC Telemed, Inc.

NXGN Management, LLC

Plantronics, Inc.

Practo

VSee

AMD Global Telemedicine Inc.

Resideo Technologies Inc. (Honeywell Life Care Solutions)

Allscripts Healthcare Solutions Inc.

Aerotel Medical Systems

Key Questions answered in the Telemedicine Market Report are:

What are the Telemedicine market segments?

Which segment in the Telemedicine market is expected to grow rapidly during the forecast period?

Which are the prominent players in the Telemedicine market?

What key trends are expected to emerge in the Telemedicine market during the forecast period?

What was the Telemedicine market size in 2023?

Which region dominated the global Telemedicine market?

Key Offerings:

Past Market Size and Competitive Landscape (2018 to 2023)

Past Pricing and price curve by region (2018 to 2023)

Market Size, Share, Size Forecast by different segment | 2024−2030

Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation – A detailed analysis by segments with their sub-segments and Region

Competitive Landscape – Profiles of selected key players by region from a strategic perspective

Competitive landscape – Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER’s analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Request for Free sample _https://www.stellarmr.com/report/req_sample/Telemedicine-Market/1601

About Stellar Market Research

Established in 2018, Stellar Market Research is an India-based consulting and advisory firm focused on helping clients reach their business transformation objectives with advisory services and strategic business. The company’s vision is to be an integral part of the client’s business as a strategic knowledge partner. Stellar Market Research provides end-to-end solutions that go beyond key research technologies to help executives in any organization achieve their mission-critical goals. The company has clients from all across the globe, 23 % from India and others from Japan, Korea, Germany, United States, etc. The company uses its extensive industry knowledge, strong network, and know-how to provide complete insights that give clients a competitive advantage.

Contact Stellar Market Research

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud,

Pune, Maharashtra, 411029

sales@stellarmr.com

+91 20 6630 3320 +91 9607365656

#HealthcareTechnology

#VirtualCare

#TelehealthSolutions

#TelemedicineAdoption

#HealthcareInnovationTelemedicine Market Overview The market growth drivers and challenges, as well as company plans, procedures, and a detailed financial strategy, are all explored in the research. Customization, as well as extensive information about Telemedicine industry potential, meets customer expectations. The global “Telemedicine market” study investigates the industry's competitive landscape and leading players. Request for Free sample _https://www.stellarmr.com/report/req_sample/Telemedicine-Market/1601 Telemedicine Market Report Scope and Research Methodology The report clearly represents a global Telemedicine Market structure, which includes current trends in the market and forecasts to identify potential investment areas. It consists of various factors affecting the global Telemedicine market such as historical data, recent technological development, competitive landscape and government policy. The Telemedicine Market report provides information on major drivers, restraints, challenges and opportunities for clients. For easy understanding, the market has been divided into three major segments and these major segments of the Telemedicine Market were further divided into various sub-segments. The report also includes a segment-wise analysis of the factors influencing the market growth with the competitive analysis, major market players have been included in the report by their expansion plans, product, investments, pricing and presence in the Telemedicine industry. Both primary and secondary research methods were used and the data collected for the Telemedicine Market report by using these methods were combined to draw accurate and error-free inferences. The primary research included interviews with subject-matter experts, Telemedicine industry participants, high-level executives of key market players, industry consultants and other experts. The Telemedicine Market report includes a PESTLE analysis, which aids in the development of company strategies. SWOT analysis was conducted to provide the strengths and weaknesses of the Telemedicine Market. Request for Free sample _https://www.stellarmr.com/report/req_sample/Telemedicine-Market/1601 Telemedicine Market Regional Insights Europe, North America, Asia-Pacific, the Middle East and Africa, and Latin America are the five regions that make up the global Telemedicine market. The report forecasts the revenue growth at global, regional and country levels in terms of USD value from 2023 to 2030. Regional analysis with the Telemedicine market size of each region is included in the report. The countries portion of the research examines a variety of market elements that are expected to influence current and future Telemedicine market trends, as well as changes in market rules at the country level. Some of the primary components used to forecast each country's Telemedicine market situation include consumption, production location and amount, import/export analysis, pricing analysis, raw material prices, and upstream and downstream value chain analysis. Telemedicine Market Segmentation By Delivery Mode On-Premise Delivery Cloud-Based Delivery By Application Teleradiology Telepsychiatry Telepathology Teledermatology Telecardiology Others By End User Providers Payers Patients Other Telemedicine Market Key Players Koninklijke Philips N.V. American Well Corporation Medtronic plc Siemens AG AMC Health, LLC The Cigna Group Teladoc Health Inc. General Electric Company Oracle Corporation MDlive, Inc. (Evernorth) Twilio Inc. Doctor On Demand, Inc. (Included Health) Zoom Video Communications, Inc. SOC Telemed, Inc. NXGN Management, LLC Plantronics, Inc. Practo VSee AMD Global Telemedicine Inc. Resideo Technologies Inc. (Honeywell Life Care Solutions) Allscripts Healthcare Solutions Inc. Aerotel Medical Systems Key Questions answered in the Telemedicine Market Report are: What are the Telemedicine market segments? Which segment in the Telemedicine market is expected to grow rapidly during the forecast period? Which are the prominent players in the Telemedicine market? What key trends are expected to emerge in the Telemedicine market during the forecast period? What was the Telemedicine market size in 2023? Which region dominated the global Telemedicine market? Key Offerings: Past Market Size and Competitive Landscape (2018 to 2023) Past Pricing and price curve by region (2018 to 2023) Market Size, Share, Size Forecast by different segment | 2024−2030 Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by region Market Segmentation – A detailed analysis by segments with their sub-segments and Region Competitive Landscape – Profiles of selected key players by region from a strategic perspective Competitive landscape – Market Leaders, Market Followers, Regional player Competitive benchmarking of key players by region PESTLE Analysis PORTER’s analysis Value chain and supply chain analysis Legal Aspects of business by region Lucrative business opportunities with SWOT analysis Recommendations Request for Free sample _https://www.stellarmr.com/report/req_sample/Telemedicine-Market/1601 About Stellar Market Research Established in 2018, Stellar Market Research is an India-based consulting and advisory firm focused on helping clients reach their business transformation objectives with advisory services and strategic business. The company’s vision is to be an integral part of the client’s business as a strategic knowledge partner. Stellar Market Research provides end-to-end solutions that go beyond key research technologies to help executives in any organization achieve their mission-critical goals. The company has clients from all across the globe, 23 % from India and others from Japan, Korea, Germany, United States, etc. The company uses its extensive industry knowledge, strong network, and know-how to provide complete insights that give clients a competitive advantage. Contact Stellar Market Research S.no.8, h.no. 4-8 Pl.7/4, Kothrud, Pinnac Memories Fl. No. 3, Kothrud, Pune, Maharashtra, 411029 sales@stellarmr.com +91 20 6630 3320 +91 9607365656 #HealthcareTechnology #VirtualCare #TelehealthSolutions #TelemedicineAdoption #HealthcareInnovation2 0 评论 0 股票 - $ETH & $BTC正处于重大供应短缺的边缘。

我坐下来

@游戏理论化

讨论这个+更多。

了解为什么2024年将成为crypto的关键一年(以及如何准备)。

现在观看 https://youtu.be/lgTDv7HpTsk

$ETH & $BTC are on the cusp of a major supply squeeze.

I sat down with

@gametheorizing

to discuss this + much more.

Find out why 2024 is shaping up to be a pivotal year for crypto (and how to prepare).

Watch now https://youtu.be/lgTDv7HpTsk$ETH & $BTC正处于重大供应短缺的边缘。 我坐下来 @游戏理论化 讨论这个+更多。 了解为什么2024年将成为crypto的关键一年(以及如何准备)。 现在观看 https://youtu.be/lgTDv7HpTsk $ETH & $BTC are on the cusp of a major supply squeeze. I sat down with @gametheorizing to discuss this + much more. Find out why 2024 is shaping up to be a pivotal year for crypto (and how to prepare). Watch now https://youtu.be/lgTDv7HpTsk 0 0 评论 0 股票

0 0 评论 0 股票 - 每周代币+叙事观察列表回来了!

许多山寨币都在流血,但这次下跌开始带来一些有趣的全面机会。

这是我本周关注的内容。

$BTC :灰度抛售压力是我们过去一周观察到的“缓慢流失”价格走势的主要原因。最近的报告表明,迄今为止几乎一半的抛售压力可归因于 FTX 地产出售其$GBTC - 现已完成。 38,000 美元的水平水平非常重要(每日)。寻找回应。

$RLB :过去几个月一直是一位神秘的表演者。最近并没有随着市场的变化而变化。然而,收入继续攀升,今天他们已经开始发布公告。我认为 RLB(按此估值)正处于一个诱人的现货积累区域,可以为多头建立头寸。

$ONDO :“新”RWA 宝石。拥有强大的股权结构表+来自“合适”人员的兴趣。重要的是,它有 Binance 和 Bybit 现货 + perps 列表。它还刚刚在 Coinbase 上市(Coinbase Ventures 投资)。具有低浮动+高 FDV 组合,通常预示着价格走势的好兆头。可能是一个不错的逢低买入。

$RNDR :很好地融入了 2 月 2 日的 Apple Vision Pro 活动。市场喜欢将代币与现实世界的事件联系起来(例如开放人工智能会议和人工智能代币)。上次 RNDR 与 Apple 事件相关时,它的走势非常激进。密切监视这一点,因为 RNDR 往往会用力泵送并产生非常浅的下降。

$MYRO :好吧,这是一个稍微有争议的问题,但它是刚刚在 Bybit 上市的 Solana memecoin。 $WIF也出现了类似的情况,其上市后股价翻了一番。密切关注这一点,以防它进行$BONK类型的运行(考虑到现在可以通过主要交易所上市更容易访问它)。

$MANTA :仍然很好地保持在 2 美元以上,并且相对于市场表现出一定的实力。考虑到围绕空投的强烈反对,如果空投发生“令人讨厌的集会”,我不会感到惊讶。这是一种新的闪亮硬币,适合当前的模块化/Celestia 叙事,并且还具有我之前提到的“低浮动高FDV”动态。

$LINK :Larry Fink 关于 RWA 的言论越来越响亮,LINK 是一种将从该领域的增长中受益匪浅的代币。您需要预言机来提供从现实世界到数字世界的价格信息。我认为 LINK 类似于 RWA 的“BTC”,因此这是一个可以很好地构建的故事。

$RSTK :随着 EigenLayer 空投的到来,市场处于一个更好的位置(与 2022/23 年相比)——我认为重新抵押是一种在未来会受到关注的说法。看起来这个周期是 2021 年 DeFi 收益率庞氏骗局的更“成熟”版本。

$METIS :出现了不错的回调(123-79 美元)。这是我去年年底错过的一笔交易,但我仍然想要入场。现在它变得越来越有吸引力。他们最近推出了一只生态系统基金,随着即将到来的 Dencun 升级,这一说法很强烈。

$JUP :Jupiter 空投于 31 日进行,他们刚刚推出了 Launchpad 的 Beta 版。我们正处于 Launchpad/IDO 赛季的早期阶段,我们知道 Jupiter 团队知道如何玩这个游戏。通常这些新产品在发布时表现良好,然后就冷却下来。那是我有兴趣建立一个职位的时候。

The Weekly Token + Narrative Watchlist is back!

Many altcoins are bleeding, but this dip is starting to present some interesting opportunities across the board.

Here's what I've got my eye on this week.

$BTC: The Grayscale selling pressure has been the primary cause of the "slow bleed" price action we have been observing over the past week. Recent reports suggest that almost half of the sell pressure so far can be attributed to the FTX estate selling their $GBTC - which has now been completed. $38k horizontal level is significant (on the daily). Looking for a response.

$RLB: Has been an enigmatic performer over the last couple of months. It hasn't been moving with the market recently. However, revenue continues to climb, and today they've begun teasing an announcement. I think RLB (at this valuation) is in a tempting spot accumulation zone to build a position for the bull.

$ONDO: A ‘new’ RWA gem. Has a strong cap table + interest from the 'right' people. Importantly, it has Binance and Bybit spot + perps listings. It also just received a Coinbase listing (Coinbase Ventures invested). Has the low float + high FDV combo that typically bodes well for price action. Potentially a nice dip buy.

$RNDR: Building nicely into the Apple Vision Pro Event on Feb 2nd. The market loves connecting tokens to real world events (e.g. Open AI conference and AI tokens). The last time RNDR was correlated to an Apple Event, it moved aggressively. Monitoring this one closely, as RNDR tends to pump hard and give very shallow dips.

$MYRO: Ok, this is a slightly more controversial one, but it's a Solana memecoin which just got listed on Bybit. Similar playbook occured with $WIF, which doubled from the time of its listing. Watching this closely in case it goes on a $BONK type run (given that it's more accessible now via major exchange listings).

$MANTA: Still holding nicely above $2, and has been showing some strength against the market. Given the backlash surrounding the airdrop, I wouldn't be surprised if it goes on a “hated rally”. It's a new shiny coin, fits the current modular/Celestia narratives, and also has the “low float high FDV” dynamics I previously mentioned.

$LINK: Larry Fink is getting louder and louder regarding the RWA narrative, and LINK is one token that will benefit immensely from the growth of this sector. You need oracles to supply price feeds from the real to the digital world. I would consider LINK akin to the “BTC” of RWA’s, so it's a narrative that could build nicely overtime.

$RSTK: With the EigenLayer airdrop coming, and market in a much better place (vs 2022/23) - restaking is a narrative that I think will gain traction in the future. Seems like this cycle's more "mature" version of 2021's DeFi yield-ponzis.

$METIS: Has had a decent pullback ($123-$79). This was a trade I missed late last year, but I still want an entry. Now it's becoming more attractive. They recently launched an ecosystem fund, and the narrative is strong with the looming Dencun upgrade.

$JUP: The Jupiter airdrop is on the 31st, and they have just launched the beta of their launchpad. We are in the early stages of a launchpad/IDO season, and we know the Jupiter team knows how to play the game. Usually these new launches do well at launch, then cool off. That is when I'm interested in building a position.

每周代币+叙事观察列表回来了! 许多山寨币都在流血,但这次下跌开始带来一些有趣的全面机会。 这是我本周关注的内容。 $BTC :灰度抛售压力是我们过去一周观察到的“缓慢流失”价格走势的主要原因。最近的报告表明,迄今为止几乎一半的抛售压力可归因于 FTX 地产出售其$GBTC - 现已完成。 38,000 美元的水平水平非常重要(每日)。寻找回应。 $RLB :过去几个月一直是一位神秘的表演者。最近并没有随着市场的变化而变化。然而,收入继续攀升,今天他们已经开始发布公告。我认为 RLB(按此估值)正处于一个诱人的现货积累区域,可以为多头建立头寸。 $ONDO :“新”RWA 宝石。拥有强大的股权结构表+来自“合适”人员的兴趣。重要的是,它有 Binance 和 Bybit 现货 + perps 列表。它还刚刚在 Coinbase 上市(Coinbase Ventures 投资)。具有低浮动+高 FDV 组合,通常预示着价格走势的好兆头。可能是一个不错的逢低买入。 $RNDR :很好地融入了 2 月 2 日的 Apple Vision Pro 活动。市场喜欢将代币与现实世界的事件联系起来(例如开放人工智能会议和人工智能代币)。上次 RNDR 与 Apple 事件相关时,它的走势非常激进。密切监视这一点,因为 RNDR 往往会用力泵送并产生非常浅的下降。 $MYRO :好吧,这是一个稍微有争议的问题,但它是刚刚在 Bybit 上市的 Solana memecoin。 $WIF也出现了类似的情况,其上市后股价翻了一番。密切关注这一点,以防它进行$BONK类型的运行(考虑到现在可以通过主要交易所上市更容易访问它)。 $MANTA :仍然很好地保持在 2 美元以上,并且相对于市场表现出一定的实力。考虑到围绕空投的强烈反对,如果空投发生“令人讨厌的集会”,我不会感到惊讶。这是一种新的闪亮硬币,适合当前的模块化/Celestia 叙事,并且还具有我之前提到的“低浮动高FDV”动态。 $LINK :Larry Fink 关于 RWA 的言论越来越响亮,LINK 是一种将从该领域的增长中受益匪浅的代币。您需要预言机来提供从现实世界到数字世界的价格信息。我认为 LINK 类似于 RWA 的“BTC”,因此这是一个可以很好地构建的故事。 $RSTK :随着 EigenLayer 空投的到来,市场处于一个更好的位置(与 2022/23 年相比)——我认为重新抵押是一种在未来会受到关注的说法。看起来这个周期是 2021 年 DeFi 收益率庞氏骗局的更“成熟”版本。 $METIS :出现了不错的回调(123-79 美元)。这是我去年年底错过的一笔交易,但我仍然想要入场。现在它变得越来越有吸引力。他们最近推出了一只生态系统基金,随着即将到来的 Dencun 升级,这一说法很强烈。 $JUP :Jupiter 空投于 31 日进行,他们刚刚推出了 Launchpad 的 Beta 版。我们正处于 Launchpad/IDO 赛季的早期阶段,我们知道 Jupiter 团队知道如何玩这个游戏。通常这些新产品在发布时表现良好,然后就冷却下来。那是我有兴趣建立一个职位的时候。 The Weekly Token + Narrative Watchlist is back! Many altcoins are bleeding, but this dip is starting to present some interesting opportunities across the board. Here's what I've got my eye on this week. $BTC: The Grayscale selling pressure has been the primary cause of the "slow bleed" price action we have been observing over the past week. Recent reports suggest that almost half of the sell pressure so far can be attributed to the FTX estate selling their $GBTC - which has now been completed. $38k horizontal level is significant (on the daily). Looking for a response. $RLB: Has been an enigmatic performer over the last couple of months. It hasn't been moving with the market recently. However, revenue continues to climb, and today they've begun teasing an announcement. I think RLB (at this valuation) is in a tempting spot accumulation zone to build a position for the bull. $ONDO: A ‘new’ RWA gem. Has a strong cap table + interest from the 'right' people. Importantly, it has Binance and Bybit spot + perps listings. It also just received a Coinbase listing (Coinbase Ventures invested). Has the low float + high FDV combo that typically bodes well for price action. Potentially a nice dip buy. $RNDR: Building nicely into the Apple Vision Pro Event on Feb 2nd. The market loves connecting tokens to real world events (e.g. Open AI conference and AI tokens). The last time RNDR was correlated to an Apple Event, it moved aggressively. Monitoring this one closely, as RNDR tends to pump hard and give very shallow dips. $MYRO: Ok, this is a slightly more controversial one, but it's a Solana memecoin which just got listed on Bybit. Similar playbook occured with $WIF, which doubled from the time of its listing. Watching this closely in case it goes on a $BONK type run (given that it's more accessible now via major exchange listings). $MANTA: Still holding nicely above $2, and has been showing some strength against the market. Given the backlash surrounding the airdrop, I wouldn't be surprised if it goes on a “hated rally”. It's a new shiny coin, fits the current modular/Celestia narratives, and also has the “low float high FDV” dynamics I previously mentioned. $LINK: Larry Fink is getting louder and louder regarding the RWA narrative, and LINK is one token that will benefit immensely from the growth of this sector. You need oracles to supply price feeds from the real to the digital world. I would consider LINK akin to the “BTC” of RWA’s, so it's a narrative that could build nicely overtime. $RSTK: With the EigenLayer airdrop coming, and market in a much better place (vs 2022/23) - restaking is a narrative that I think will gain traction in the future. Seems like this cycle's more "mature" version of 2021's DeFi yield-ponzis. $METIS: Has had a decent pullback ($123-$79). This was a trade I missed late last year, but I still want an entry. Now it's becoming more attractive. They recently launched an ecosystem fund, and the narrative is strong with the looming Dencun upgrade. $JUP: The Jupiter airdrop is on the 31st, and they have just launched the beta of their launchpad. We are in the early stages of a launchpad/IDO season, and we know the Jupiter team knows how to play the game. Usually these new launches do well at launch, then cool off. That is when I'm interested in building a position.4 0 评论 0 股票 - The #Bitcoin DeFi/BRC20的叙事是我对2024年最高信念的部门之一。由于这仍是一个相对新生的行业,许多顶级基础设施项目尚未获得独立开发机构的批准。因此,你有机会早早入市——有巨大的上升空间。昨天,我们第一次体验了$SAVM,但未来还会有更多。接下来我特别期待的一个项目是

@贝菲实验室

. 这是一个多钱包集成的BRC20交易终端,允许您轻松地通过Metamask等交易这些资产。跨越多条链。可以把它想象成$BTC网络的$WOO。我看好这个概念,而且该团队已经有一堆合作伙伴排队等候。那么,怎样才能进去呢?首先,你可在以下网址登记IDO

@剧院终端

. 如果你足够幸运,得到一个分配,这将可能保证巨大的利润。然而,如果你不这样做,有多种方法来接近购买(如果你是看涨的)。·狙击发射使用令牌狙击手(高级)。· 上市后不久在公开市场上买入(如果估值合理)。这对SAVM很有效。总是为你设定一个基准市值预期来校准你的基准。·在重大下跌时买入。新的发射通常不会只上升。随着解锁的发生(和早期的卖家被淘汰),通常会有深度的修正,让你获得条目。这些都是一些策略,但我可能会做一个完整的指南,在不久的将来获得/交易IDO。(充分披露:我是BeFi实验室的投资者)这只是我在BRC20部门内感兴趣的许多项目之一。我的完整帖子,揭示了我的其他一些话题选择,将在未来几天内下降。转发这篇文章,如果你也看好BRC20!

以下为原文

The #Bitcoin DeFi/BRC20 narrative is one of my highest conviction sectors for 2024. As this is still a relatively nascent sector, many of the top infrastructure projects are yet to IDO. Thus, you have an opportunity to get in early - with massive upside. We got our first taste with $SAVM yesterday, but there are many more to come. One project that I'm particularly looking forward to next is

@BefiLabs

. It's a BRC20 trading terminal with multi-wallet integration, allowing you to easily trade these assets with Metamask etc. across multiple chains. Think of it as the $WOO of the $BTC network. I'm bullish on the concept, and the team already has stacks of partnerships lined up. So, how can you get in? Firstly, you can register for the IDO on

@theapeterminal

. If you're lucky enough to get an allocation, this will likely guarantee huge profits. However, if you don't, there are multiple ways to approach buying (if you're bullish). • Snipe the launch using a token sniper (advanced). • Buy shortly after launch on the open market (if valuation if reasonable). This worked well for SAVM. Always set a benchmark market cap expectation for you to calibrate your baseline. • Buy major dips. New launches usually aren't up only. As unlocks occur (and early sellers are flushed out), often there are deep corrections which allow you to get entries. Those are some strategies, but I might do a full guide on getting/trading IDOs in the near future. (full disclosure: I'm an investor in BeFi Labs) This is just one of many projects I'm interested in within the BRC20 sector. My full thread, revealing some of my other topic picks, will be dropping in the coming days. Retweet this post if you're also bullish on BRC20!The #Bitcoin DeFi/BRC20的叙事是我对2024年最高信念的部门之一。由于这仍是一个相对新生的行业,许多顶级基础设施项目尚未获得独立开发机构的批准。因此,你有机会早早入市——有巨大的上升空间。昨天,我们第一次体验了$SAVM,但未来还会有更多。接下来我特别期待的一个项目是 @贝菲实验室 . 这是一个多钱包集成的BRC20交易终端,允许您轻松地通过Metamask等交易这些资产。跨越多条链。可以把它想象成$BTC网络的$WOO。我看好这个概念,而且该团队已经有一堆合作伙伴排队等候。那么,怎样才能进去呢?首先,你可在以下网址登记IDO @剧院终端 . 如果你足够幸运,得到一个分配,这将可能保证巨大的利润。然而,如果你不这样做,有多种方法来接近购买(如果你是看涨的)。·狙击发射使用令牌狙击手(高级)。· 上市后不久在公开市场上买入(如果估值合理)。这对SAVM很有效。总是为你设定一个基准市值预期来校准你的基准。·在重大下跌时买入。新的发射通常不会只上升。随着解锁的发生(和早期的卖家被淘汰),通常会有深度的修正,让你获得条目。这些都是一些策略,但我可能会做一个完整的指南,在不久的将来获得/交易IDO。(充分披露:我是BeFi实验室的投资者)这只是我在BRC20部门内感兴趣的许多项目之一。我的完整帖子,揭示了我的其他一些话题选择,将在未来几天内下降。转发这篇文章,如果你也看好BRC20! 以下为原文 The #Bitcoin DeFi/BRC20 narrative is one of my highest conviction sectors for 2024. As this is still a relatively nascent sector, many of the top infrastructure projects are yet to IDO. Thus, you have an opportunity to get in early - with massive upside. We got our first taste with $SAVM yesterday, but there are many more to come. One project that I'm particularly looking forward to next is @BefiLabs . It's a BRC20 trading terminal with multi-wallet integration, allowing you to easily trade these assets with Metamask etc. across multiple chains. Think of it as the $WOO of the $BTC network. I'm bullish on the concept, and the team already has stacks of partnerships lined up. So, how can you get in? Firstly, you can register for the IDO on @theapeterminal . If you're lucky enough to get an allocation, this will likely guarantee huge profits. However, if you don't, there are multiple ways to approach buying (if you're bullish). • Snipe the launch using a token sniper (advanced). • Buy shortly after launch on the open market (if valuation if reasonable). This worked well for SAVM. Always set a benchmark market cap expectation for you to calibrate your baseline. • Buy major dips. New launches usually aren't up only. As unlocks occur (and early sellers are flushed out), often there are deep corrections which allow you to get entries. Those are some strategies, but I might do a full guide on getting/trading IDOs in the near future. (full disclosure: I'm an investor in BeFi Labs) This is just one of many projects I'm interested in within the BRC20 sector. My full thread, revealing some of my other topic picks, will be dropping in the coming days. Retweet this post if you're also bullish on BRC20!3 0 评论 0 股票 - block face 分享了一个链接吴说获悉,据社区反馈,Gate 在上线 BRC-20 RATS 后存在数据砸盘成交的情况。

在 12 月 4 日 21:00-23:00 的两个小时里,Gate 站内 RATS 成交量超过了 8,800 亿,而 RATS 总量为 1 万亿,再结合 Gate 持有余额,这显然是异常的。在此两小时内 RATS 一度下跌超过 10%。目前 CoinCarp 标记为 Gate 地址(16G1xY…Vp9Wxh)持有约 4.7% 的 RATS 总量,是最大持仓。Gate 暂未对此事做出回应。

https://wublock123.com/index.php?m=content&c=index&a=show&catid=7&id=21279吴说获悉,据社区反馈,Gate 在上线 BRC-20 RATS 后存在数据砸盘成交的情况。 在 12 月 4 日 21:00-23:00 的两个小时里,Gate 站内 RATS 成交量超过了 8,800 亿,而 RATS 总量为 1 万亿,再结合 Gate 持有余额,这显然是异常的。在此两小时内 RATS 一度下跌超过 10%。目前 CoinCarp 标记为 Gate 地址(16G1xY…Vp9Wxh)持有约 4.7% 的 RATS 总量,是最大持仓。Gate 暂未对此事做出回应。 https://wublock123.com/index.php?m=content&c=index&a=show&catid=7&id=21279Gate 在上线 BRC-20 RATS 后疑似存在虚假的代币数据交易吴说获悉,据社区反馈,Gate 在上线 BRC-20 RATS 后存在数据砸盘成交的情况。在 12 月 4 日 21:00-23:00 的两个小时里,Gate 站...WUBLOCK123.COM0 0 评论 0 股票 - First, here's the most important thing, the link:

https://nvlpubs.nist.gov/nistpubs/ai/NIST.AI.100-2e2023.pdf

Next, I'm going to show one reason why this report is so good.

首先,这是最重要的事情,链接:

https://nvlpubs.nist.gov/nistpubs/ai/NIST.AI.100-2e2023.pdf

First, here's the most important thing, the link: https://nvlpubs.nist.gov/nistpubs/ai/NIST.AI.100-2e2023.pdf Next, I'm going to show one reason why this report is so good. 首先,这是最重要的事情,链接: https://nvlpubs.nist.gov/nistpubs/ai/NIST.AI.100-2e2023.pdf2 0 评论 0 股票 - Vitalik Buterin 分享了一个链接A PoS simplification proposal: make a design that only requires 8192 signatures per slot (even with SSF), making the consensus implementation considerably simpler and lighter.

PoS 简化提案:设计一个每个时隙只需要 8192 个签名的设计(即使使用 SSF),使共识实现变得更加简单和轻便。

https://ethresear.ch/t/sticking-to-8192-signatures-per-slot-post-ssf-how-and-why/17989

A PoS simplification proposal: make a design that only requires 8192 signatures per slot (even with SSF), making the consensus implementation considerably simpler and lighter. PoS 简化提案:设计一个每个时隙只需要 8192 个签名的设计(即使使用 SSF),使共识实现变得更加简单和轻便。 https://ethresear.ch/t/sticking-to-8192-signatures-per-slot-post-ssf-how-and-why/17989Sticking to 8192 signatures per slot post-SSF: how and whyA major difference between Ethereum and most other (finality-bearing) proof of stake systems is that Ethereum tries to support a very high number of validators: we currently have 895,000 validator objects and a naive Zipf’s law analysis implies that this corresponds to tens of thousands of unique invididuals/entities. The purpose of this is to support decentralization, allowing even regular individuals to participate in staking, without requiring everyone to give up their agency and cede control...ETHRESEAR.CH0 0 评论 0 股票

没有结果显示

没有结果显示

没有结果显示

没有结果显示

© 2024 FaceBlock:信誉IP社交 · 简体中文